HIGHLY COMPLEX AND EXTREMELY IMPORTANT:

Your reliable and proactive partner

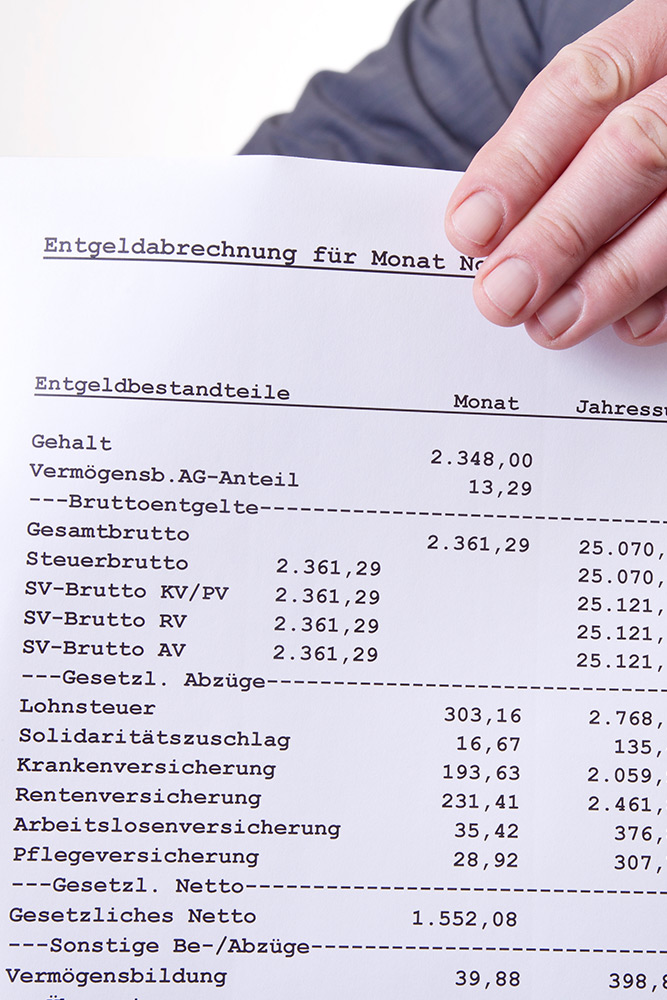

WE ARE HAPPY TO ASSIST YOU WITH YOUR PAYROLL ACCOUNTING

The importance of qualified and well-trained staff is increasingly crucial for entrepreneurs and companies. In addition to recruiting suitable personnel, proper and up-to-date payroll accounting is of crucial importance.

Due to the escalating and constantly growing regulations in Germany, setting up and maintaining a proper payroll accounting is becoming more and more complex and demanding. It therefore often is a high risk for the managing director and the entrepreneur to ensure full compliance with the German provisions. This especially applies if employers are not proficient in German, as the German system still does not offer many information and crucial documents in other languages. All too often, these result in the unwelcome consequences that can culminate in personal liability or fines due to non-compliance. Our multilingual team is happy to assist you and thereby helping you to focus on the key issues in setting up and running your operations in Germany.

Compliance with the resulting obligations and the preparation of a proper pay slip represent a challenge that should not be underestimated. The regularly occurring external wage tax audit, social security and artists' social security fund audit, professional association audit and KUG audits also pose particular hurdles for employers.

Furthermore, in addition to economic incentives for employees, modern remuneration models also offer the possibility of reducing the burden on the employer and at the same time increasing the net salary of the employee by means of remuneration components optimized for levies and taxes.

We are happy to assist you in managing your payroll thereby ensuring compliance, avoiding unnecessary risks and setting up an attractive and tax- optimized payroll helping to acquire and maintain their German work force.

OUR EXPERIENCE AND EXPERTISE – YOUR BENEFIT

We also offer a comprehensive solution for our clients in the area of payroll and payroll accounting. Our experienced and multilingual team of specialists in the field of payroll accounting will be happy to support you.

Based on a comprehensive service approach, we cover the entire spectrum of payroll accounting. The creation of ongoing payslips, the optimization of salary components, the supervision of tax audits and many other topics are part of our everyday work. We also ensure that all relevant data and documents are properly archived and available to you at all times.

We are happy to keep an overview for you, take care of the ongoing payroll accounting and advise you individually in the various subject areas.

Feel free to contact us.

HOW WE CAN HELP

1

While we take over the payroll accounting you can focus on your core business

2

Ensure full compliance

3

Increase efficiency and save time

4

High availability with quick response to your concerns

5

Cost advantage compared to the company's internal accounting of salaries

6

Fast processing through the use of the latest payroll accounting software (DATEV)

7

Expert knowledge to answer challenging questions

8

No need to become a German payroll and social security expert – We are here to help!

9

We organize and take over payroll and social security audits

10

Ensuring high data security with our DATEV system

11

Access to foreign consultant colleagues via our international network

12

Benefit from our extensive professional network, consisting of lawyers specializing in employment law

OUR PAYROLL ACCOUNTING AND PAYROLL SERVICES

- Ongoing payroll accounting, registration and deregistration of employees with social security; Transmission of contribution statements and wage tax registration, reports to professional associations and management of wage accounts and annual wage accounts

- Special calculations (e.g. maternity allowance, garnishments, royalties, etc.)

- Preparation of all relevant certificates as part of payroll, e.g. payslips, employment statements, income tax statements, etc.

- Preparation of applications such as the application for short-time work benefits

- Sickness and maternity reimbursement requests of employees

- Assistance with wage tax audit and social security audit

- Calculation and optimization of labour costs

- Simulation of salary increases

- Advice on salary optimization for your employees (more net than gross)

- Advice on company pension schemes for employees

- Advice on all accounting matters such as comparison of different tax characteristics, e.g. wage tax class comparison, child allowances

- Travel expense reports

- Management of vacation statistics

- Access to modern IT systems (e.g. DATEV employees online DATEV companies online)

- Management of electronic payment transactions as part of payroll accounting (transmission of payment orders to your bank, etc.)

WHICH DOCUMENTS ARE NECESSARY FOR YOUR CURRENT PAYROLL ACCOUNTING?

We would be happy to show you directly which documents we need from you for payroll accounting and payroll accounting.

HOW OUR PAYROLL ACCOUNTING PROCESS WORKS:

- After hiring a new employee, we need the necessary payroll data from you. We provide you with our checklists for this purpose.

- By the 15th of the month, communicate any changes regarding your personal data for the current month. As a precaution, we allow for several working days for the preparation of the wage and salary slips for checks, queries and any necessary correction runs.

- As a rule, you will receive the following evaluations from us around the 20th, in writing or by e-mail:

- Pay slips for forwarding to the employees, enveloped if desired

- Open payslips for internal filing

- Copy of the wage tax return for internal filing

- Copies of contribution statements for internal filing

- Overview of forthcoming payments to the financial office and health insurance companies - The data records for your wages and salaries are usually sent to the computer center of your house bank via data transmission and must be approved by you at your house bank before they can be carried out, usually by forwarding the signed DTA protocol by fax.

- If you have now given the tax office and the health insurance companies direct debit authorizations, you do not have to do anything else.

DOWNLOAD

You can download our payroll mandate checklist as a PDF here.

If you have any questions or concerns, please feel free to contact us at any time.

Please find our contact details below.

Via E-Mail: lohnbuchhaltung@schlecht-partner.de

Schlecht und Partner

Leopoldstraße 158

80804 Munich, Germany

Phone: +49 (0)89 24 29 16 0

Schlecht und Partner

Königstorgraben 11

90402 Nuremberg, Germany

Phone: +49 (0)911 47 78 12 0

Schlecht und Partner

Friedhofstraße 45/47

70191 Stuttgart, Germany

Phone: +49 (0)711 40 05 40 50